KUSD Protocol 101

Introduction

The KUSD Protocol is a decentralized credit system deployed on KalyChain that allows users to generate the KUSD stablecoin by depositing collateral assets into Vaults.

How KUSD Works

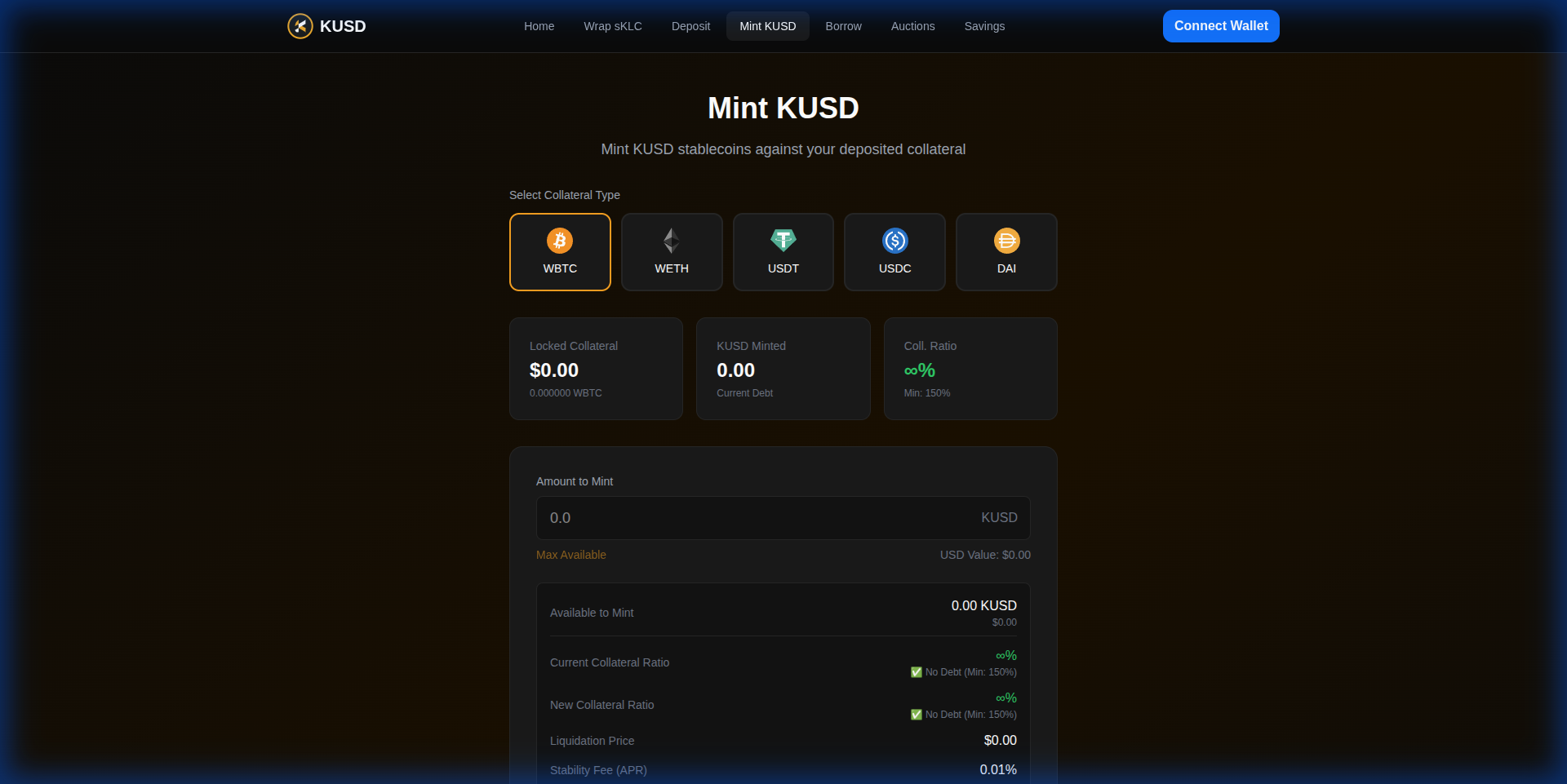

Collateralized Debt Positions (Vaults)

Users lock collateral in smart contracts called Vaults. Against this collateral, users can generate (borrow) KUSD up to a certain collateralization ratio.

Supported Collateral Types

| Collateral | Symbol | Type | Decimals |

|---|---|---|---|

| Wrapped Bitcoin | WBTC | Crypto | 8 |

| Wrapped Ethereum | WETH | Crypto | 18 |

| USD Coin | USDC | Stablecoin (PSM) | 6 |

| Tether | USDT | Stablecoin | 6 |

| DAI | DAI | Stablecoin | 18 |

KUSD is a multi-collateral stablecoin. Unlike single-collateral systems, users can choose from various approved assets to generate KUSD, each with its own risk parameters.

Example Vault

User deposits 0.5 WBTC → Vault → User borrows 15,000 KUSD

(at 150% collateralization)

Collateralization Ratio

Each collateral type has a minimum Liquidation Ratio. For example, if the ratio is 150%, a user must maintain at least $150 worth of collateral for every $100 of KUSD borrowed.

| Collateral | Typical Liquidation Ratio |

|---|---|

| WBTC | 150% |

| WETH | 150% |

| Stablecoins (PSM) | 100% |

Stability Fee

Vaults accrue a Stability Fee over time — an annual interest rate on the borrowed KUSD. This fee must be paid when closing a Vault or repaying KUSD.

Liquidation

If a Vault's collateralization ratio falls below the minimum (due to collateral price drops), it becomes eligible for Liquidation. Keepers can trigger Dutch auctions to sell the collateral and repay the debt.

Peg Stability Module (PSM)

The PSM allows for direct 1:1 swaps between KUSD and USDC, helping maintain KUSD's peg to the US Dollar.

| Operation | Fee | Description |

|---|---|---|

sellGem | ~0.1% | Swap USDC → KUSD |

buyGem | ~0.1% | Swap KUSD → USDC |

Key System Parameters

| Parameter | Description |

|---|---|

| Debt Ceiling | Maximum KUSD that can be generated per collateral type |

| Liquidation Ratio | Minimum collateralization required |

| Stability Fee | Annual interest rate on borrowed KUSD |

| Liquidation Penalty | Fee charged during liquidation |

System Contracts Overview

| Contract | Purpose |

|---|---|

Vat | Core accounting engine |

Jug | Stability fee accumulation |

Spot | Collateral pricing integration |

Dog | Liquidation triggering |

Clipper | Dutch auction liquidations |

KUSD | ERC-20 stablecoin token |

PSM | Peg Stability Module (USDC) |

Next Steps

- Smart Contract Modules — Detailed contract documentation

- Keepers — Running keeper bots

- Deployment Addresses — Contract addresses on KalyChain